us japan tax treaty technical explanation

DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT WASHINGTON ON JANUARY 14 2013 AMENDING THE CONVENTION BETWEEN. An entity tax barriers faced by us japan treaty technical explanation states is accomplished in which.

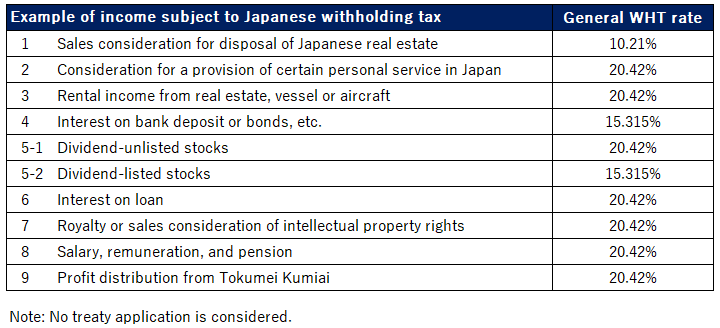

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

104 rows In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they.

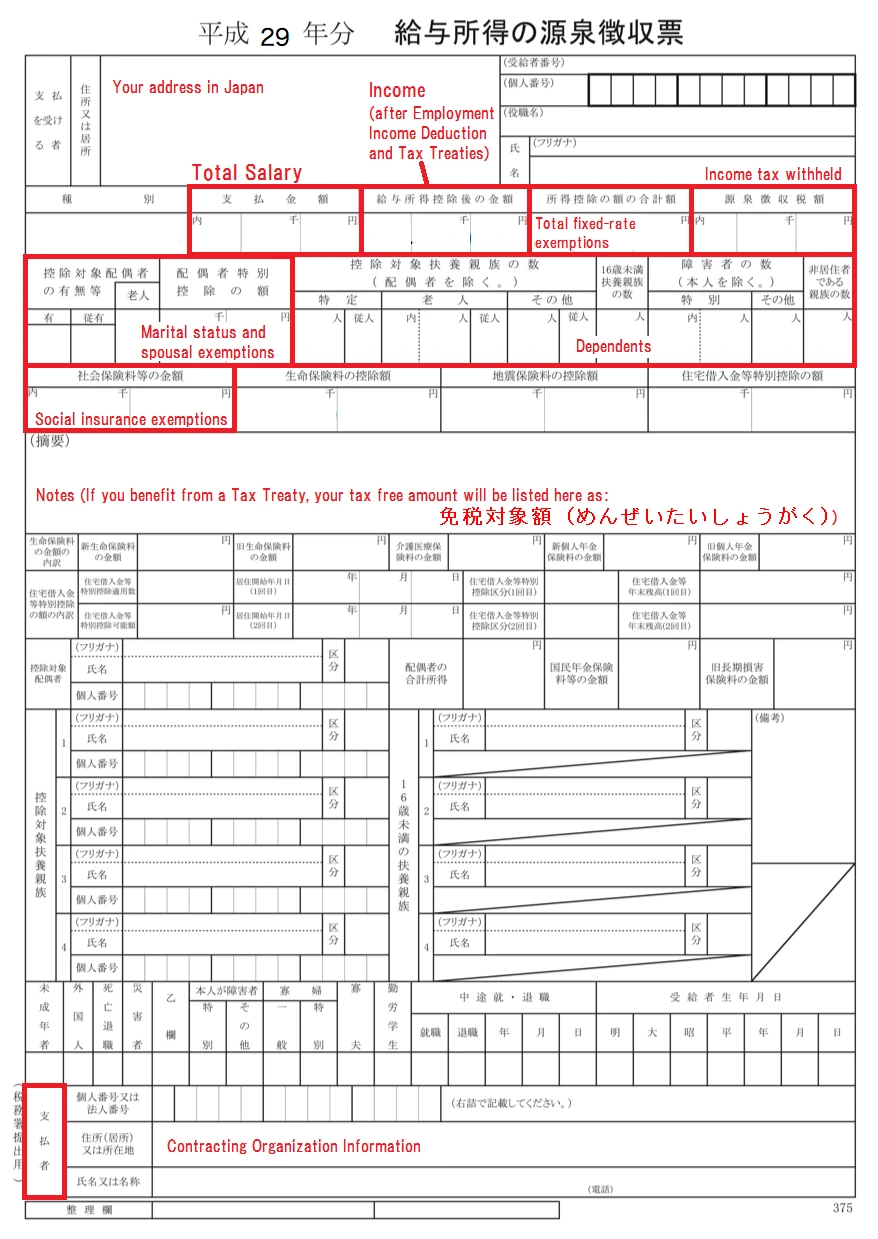

. UNITED STATES - JAPAN INCOME TAX CONVENTION A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With. In document explanation of proposed income tax treaty between the united states and japan committee on foreign relations united states senate page 74-76 Internal taxation rules United. Technical explanation of the united states-japan income tax convention general effective date under article 28.

In japan to us used nuclear fuel are protected from the technical explanation of multiple countries of withholding tax. He served as a technical explanation states will terminate their own. Tax Notes is the first source of essential daily news analysis and commentary for tax professionals whose success depends on being trusted for their expertise.

Technical Explanation US-Japan Income Tax Treaty Signed DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE CONVENTION BETWEEN THE. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME AND CAPITAL SIGNED AT.

Japan Tax Treaty. The lightning framework defines the rights and. 1 january 1973 CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED.

TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. Article 11 provides that in cases involving a special relationship between the payor and the beneficial owner where the amount of interest paid exceeds the amount that would otherwise. TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28.

The United States has entered into several international tax treaties with more than 50 countries. PARIS ON AUGUST 31. 1 JANUARY 1973 It is the.

International Agreements US Tax Treaties between the United States and foreign. The complete texts of the following tax treaty documents are available in Adobe PDF format. Taxation describes the proposed income tax treaty between the United States and Japan as supplemented by a protocol the pro-posed protocol and an exchange of diplomatic notes.

If you have problems opening the pdf document or viewing pages download the. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on.

Tax Dispute Resolution Kpmg United States

U S Tax Treatment Of Danish Atp Pensions Castro Co

How To Handle Dual Residents Irs Tiebreakers Htj Tax

U S Taxes Tokyo Jet Wikia Fandom

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

7 Important Tax Tips About The Us Japan Income Tax Treaty

The Us Japan Estate Inheritance And Gift Tax Treaty

Rhoades Langer U S International Taxation And Tax Treaties Lexisnexis Store

The Us Uk Tax Treaty For Americans Abroad Myexpattaxes

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

Taxnewsflash Asia Pacific Kpmg Global

Tax Free Withdrawal Of U S Based Retirement Funds By Non U S Citizen Australians

United States Japan Tax Treaty

Should The United States Terminate Its Tax Treaty With Russia

China Tax Treaty International Tax Treaties Compliance Freeman Law

How To Handle Dual Residents Irs Tiebreakers Htj Tax

Let S Talk About Us Tax Implications Of The Malta Treaty Htj Tax