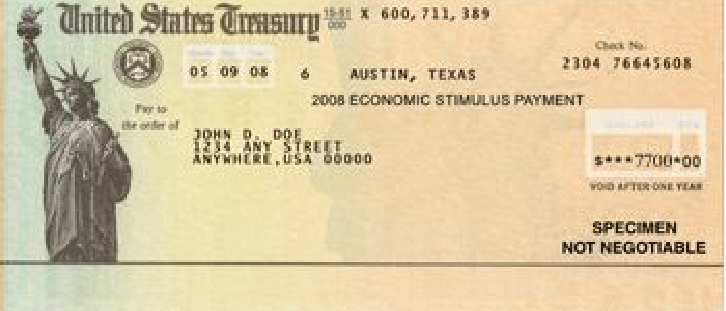

cash tax refund check with two names

For example the Walmart check cashing policy in Texas and elsewhere in the US. Millions of people have trusted our service to file their taxes for free and customers rated it 48 out of 5 stars.

What Is A Two Party Check Where Can You Cash It Mybanktracker

If you receive such a check you can tell how to deposit it at Advantis by noting how both names are written in the Payable To line.

. I submit the check and the bank gives me the cash. One party cant cash the check alone or attempt to deposit it in an account that is not held jointly with their spouse. Fees for checks between 200001 and 5000 start at 550 with Shoppers Card.

And a request that IRS to reissue the check in the name of the survivor. Some banks require a refund from a joint income tax return to be deposited into a joint bank account. Imposes a 4 fee on all transactions up to 1000 and 8 for transactions above that amount.

If the names are separated by a comma or andor or nothing at all you can endorse and cash the check yourself. What should I do. I received my US federal tax return earlier this month.

It is also called a joint check or a multi-party check. Tax Refund Check Payable to Deceased Person - 121504 0628 PM. Banks seem to be more stringent when youre depositing a tax refund check thats written to more than one payee -- Bank of America and.

My bank wont allow me to depositcash it without having him present or having a joint account. Uniform Commercial Code regulations determine how the payees may present the check but other than that the cashing process is the same as that for a one-payee check. However a refund check may be issued in only one name if requested by a spouse filing an injured spouse claim or.

Joint return it typically issues the refund in the names of both spouses leaving them to divide the proceeds. MY NAME MOTHERS NAME 111 EXAMPLE ROAD AUSTIN TX. If the issuer of the check lists the names with the word or in between them or the names are listed separately one to each line then either person may cash the check without the others permission.

The format varies by state for refund checks but IRS joint refund checks are addressed with an and separating the names. If you do not check with your bank in advance it could refuse the refund causing it. If you are married and file taxes jointly so that the names of you and your spouse appear on the income tax check both of you must be present when the income tax check is cashed and both must have government-issued photo identification on hand.

Check your local Money Services. You wont be able to cash it however you can deposit it into your own account it does not have to be a joint account as long as one of your names on that. Up to 2 cash back Check cashing fees start at 3 with Shoppers Card for checks up to 2000.

Last year I attempted the same procedure with our Federal tax refund check also made out to my wife AND me. When a check is payable to two parties the cashing of the check is more. When the Internal Revenue Service issues a tax refund to joint taxpayers in the form of a check you will receive the check with both of your names printed on it.

When I first looked at the check I noticed it had a symbol followed by my mothers name on the line below the one with my name. If the names are separated by the words or or andor or by a comma or if each name is on a separate line. One or the other only.

Fees limits vary by state. Its even possible to sign the check over to a family member. I think it was a tax refund check so that might have made a difference too SInce that happened I never make checks out to two people anymore.

On the other hand when you come to cash a check online youre not cashing it per se youre depositing it into your bank account. The bank refused to cash the check and would not deposit the check citing some rule that the US Government requires her to be present to endorse the check. Otherwise any party named on the check can deposit it into his or.

They can visit a check cashing store use the check cashing desk at a retail store or have the refund placed on a prepaid debit card. The presence of and or and between names signify whether the couple must cash the check together or whether either party can cash it alone. Most of the year the limit on check cashing is 5000 but from January to April during prime tax refund season the limit rises to 7500.

A two-party check is one with two payee names. It dictates who can cash a joint check based on how it is written. Cash App Taxes formerly Credit Karma Tax is a fast easy 100 free way to file your federal and state taxes.

I would write on the back of the check for deposit only and deposit it in through the ATM. Further if the check is payable to you or your deceased husband then no problem at all. We dont have a joint account.

This means if youre looking for cash you can hold in your hand right now then youll need to head into your bank or closest check cashing place. How can I cash a jointly tax refund check with both spouse names on it if one spouse live in overseas. They felt badly about it and they eventually did cash it for me but they made sure I knew they were bending the rules for me.

If you plan to cash the check independently alert the other party so you can avoid possible. My federal and state tax refund checks are made payable to me and my spouse who is incarcerated. You have the legal right to the proceeds.

I dont even use or anymore. However if you are cool with having the funds deposited into your bank then cash your. Cashing a check with two names on it can be done in one of two main different ways depending on how the names are written out.

We might be talking about a 400 check or a 40000 check and the personal representative might take a dim view of the IRS declaring a right of. Individuals who do not have a bank account can cash their Federal tax refund checks another way. If the check lists the names with.

Because banks have strict regulations for cashing checks made out to two parties youll have a lesson in togetherness as you cash a joint tax refund. Now that tax season has officially begun some Advantis members may receive tax refund checks from the IRS made out to two names. To cash a check with 2 names separated by and contact your bank or financial institution since every bank has its own rules about this.

Posted on Feb 24 2015. By requiring the joint payees to endorse the refund check both parties are put on notice that a refund check was issued. If a check with two names says and on the pay to the order of line then everyone has to endorse the check.

I filed jointly for us. Im pretty certain this is in the 24 category.

What Do Do If You Still Haven T Received Your Tax Refund Tom S Guide

Where S My Tax Refund Check When You Ll Get Your Irs Payment Cnet

Phony Tax Refunds A Cash Cow For Everyone Krebs On Security

Direct Deposit Will Give You A Faster Tax Refund How To Set It Up Cnet

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Social Security Recipients Should Expect Stimulus Payment By April 7 Says Irs The Washington Post

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

Get Our Example Of Direct Deposit Payroll Authorization Form Legal Questions Payroll Being A Landlord

Where S My Second Stimulus Check In 2021 Prepaid Debit Cards Visa Debit Card Tax Refund